Editor's note: In 2022, Aidvantage took over for Navient for federal student loans. Additionally, Navient announced on January 13, 2022, that they had reached a settlement with 39 state Attorneys General, providing $1.7 billion in forgiveness to some borrowers with private student loans held by the company. The private student loans were mostly issued by Sallie Mae before 2010, and virtually all of them were in default. You could be eligible if you owe private student loans to Navient that are currently in default that you borrowed before 2010. In addition, 350,000 borrowers with federal loans serviced by Navient who were steered into forbearance will receive an average payment of $260. We include the full details of who qualifies and when to expect relief in the article below.

Navient has consistently ranked as one of the most disliked student loan servicers among borrowers. There are also several Navient lawsuits that contend the servicer’s missteps have indeed entered into criminal territory. With so many customer service and repayment guidance complaints, student loan borrowers need to be aware of options for Navient student loan forgiveness.

Here’s a quick update on major happenings with Navient.

It’s important to understand there are no exclusive Navient student loan forgiveness programs. However, there are many general student loan forgiveness programs that Navient borrowers may be eligible for. Additionally, some student loan borrowers might be automatically eligible for loan cancellation or restitution payments due to the recent settlement.

Let’s take a look at the Navient loan forgiveness options available today.

Despite once being the same company, Navient and Sallie Mae are now completely separate organizations. Navient loan forgiveness is not the same as Sallie Mae loan forgiveness.

Because of its history with Sallie Mae, however, Navient services a mix of private and federal student loans. You’ll want to know which kind you have. It makes a big difference in terms of which forgiveness programs you qualify for.

To find out what kind of student loans you have with Navient, you can contact them directly or conduct a “Financial Review” on the National Student Loan Data System (NSLDS).

If you have federal student loan debt, those loans will be eligible for federal forgiveness programs like Public Service Loan Forgiveness (PSLF Program). But private student loans won’t be. Private student loans may be eligible for forgiveness through state or profession-specific student loan forgiveness programs. For a full list of programs, check out the Ultimate Guide to Student Loan Forgiveness.

On January 13, 2022, a major settlement was announced that will provide “relief totaling $1.85 billion to resolve allegations of widespread unfair and deceptive student loan servicing practices and abuses in originating predatory student loans”, according to the Pennsylvania Attorney General.

Although the settlement allows Navient to dodge any admission of misconduct, it requires Navient to:

If you qualify for loan cancellation under this settlement, you’ll be automatically notified by Navient by July 2022. You should receive a refund for any payments made on the canceled debt after June 30, 2021.

If you’re eligible for restitution payments, be sure to update your address and contact information within your StudentAid.gov account from the U.S. Department of Education. You should receive a postcard in the mail from the settlement administrator sometime in spring 2022.

Although you don't have to do anything to receive loan cancellation or restitution payments under the Navient settlement, you might still be wondering if you qualify.

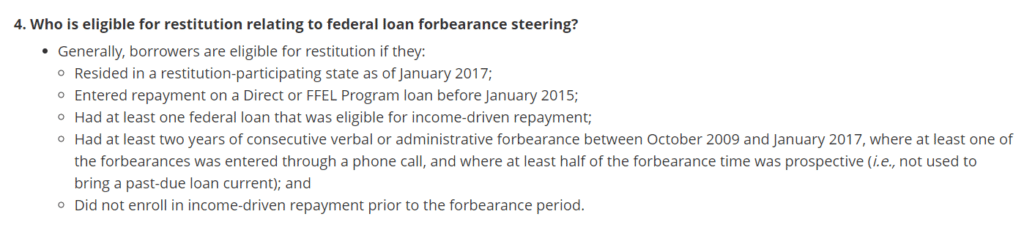

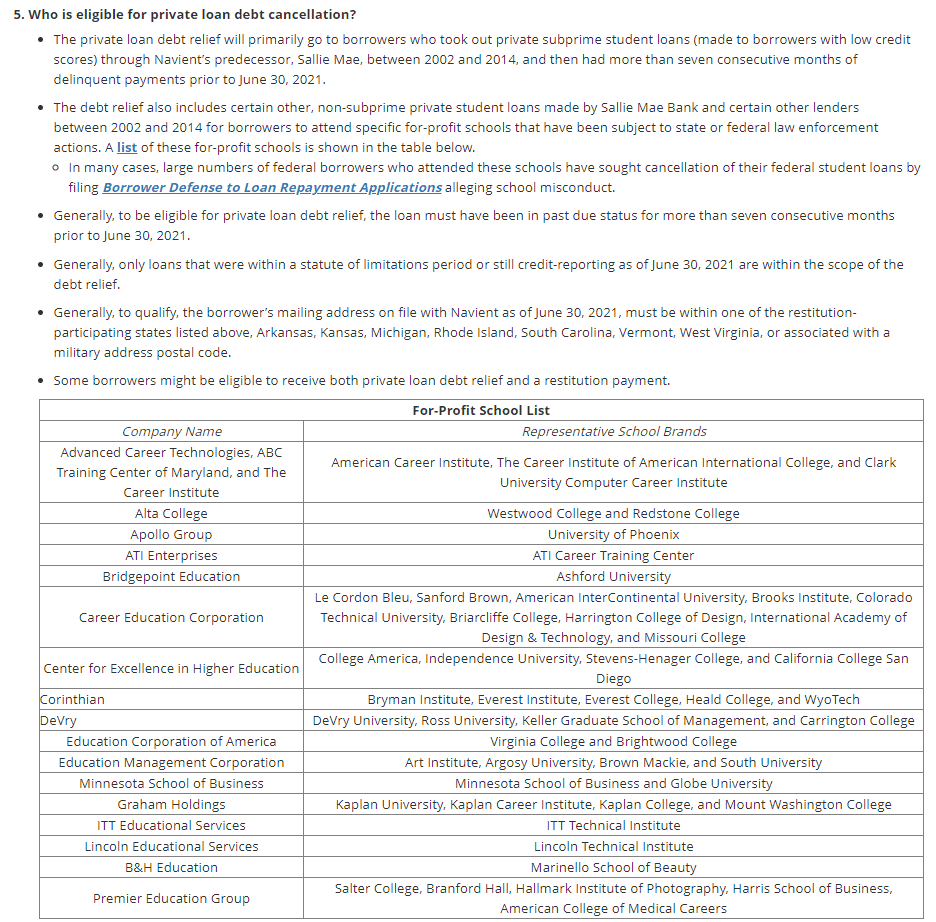

Here's a brief summary, including images from the “Common Questions” section of the Navient Multi-State Settlement informational website.

If you had federal student loans with Navient, they are likely now with Aidvantage. Here are several forgiveness options that are available to you.

Currently, the Office of Federal Student Aid at the Department of Education offers four income-driven repayment plans for its loans.

By taking advantage of these income-driven repayment plans, you may be able to lower your monthly payment amount. Plus, you may be eligible to receive Navient student loan forgiveness once you reach the end of your repayment schedule.

Depending on the plan that you choose, you’ll be eligible for forgiveness in 20 to 25 years. But you’ll want to stay vigilant to make sure that your federal student loan payments are being handled correctly. And you’ll need to recertify your income and family size each year.

And keep in mind, if you do receive forgiveness, you’ll owe income tax on the forgiven amount. So if income-driven repayment (IDR) forgiveness is your strategy, make sure to save a little money each year for the tax bill that’s coming down the road.

If you work for a qualifying employer in the public sector, such as the government or a non-profit organization, the Public Service Loan Forgiveness program is probably your best student loan forgiveness option. With PSLF, you can earn tax-free student loan forgiveness in as little as 10 years (or 120 qualifying student loan payments).

It should be pointed out that the Department of Education has selected FedLoan Servicing as the exclusive servicer of the Public Service Loan Forgiveness program. This means you can only qualify for this program if FedLoan is your servicer. But don’t worry if you’re with Navient right now.

You can apply for PSLF on the StudentAid.gov website. If you’re accepted to the program, Navient will automatically transfer your federal student loans to FedLoan Servicing. The Department of Education says that it will notify you if you’ve been accepted to the program. But if it’s taking longer than you think is reasonable to get an answer, you can call FedLoan Servicing at 1-855-265-4038 to ask for a status update.

Note that Parent PLUS Loans don't qualify for PSLF. However, Parent PLUS borrowers can become eligible by taking out a Direct Consolidation Loan. It's also important to understand that, with Parent PLUS Loans, it's the parent's employment that must qualify for PSLF, not the student's.

Teachers might be eligible for up to $17,500 of Navient student loan forgiveness through the Teacher Loan Forgiveness Program.

But to qualify, you’ll need to be considered a “highly qualified” teacher by the Federal Student Aid office at the Department of Education. And you’ll need to teach five consecutive academic years in a low-income elementary school, secondary school, or educational service agency.

It’s important to point out that PSLF and Teacher Loan Forgiveness don’t mix well. In many cases, you might be better off sticking with PSLF.

This isn't technically a “forgiveness” option. But it should be noted that there are several ways that federal student loan borrowers can become eligible to have their student loans discharged.

One example is Total and Permanent Disability (TPD) discharge. To qualify for TPD discharge, you'll need to provide medical documentation of your disability. Eligible loans for Total and Permanent Disability (TPD) discharge include Direct Loans, FFEL loans, and Perkins Loans.

The Federal Student Aid Office will also discharge your student loans if you die or, in the case of a Parent PLUS Loan, your parent dies. Other federal discharge options include closed school discharge, false certification or unauthorized payment discharge, and borrower defense discharge.

If you have private student loans and don’t qualify for any of the above student loan cancellation programs — or even if you do — you may want to consider refinancing your Navient student loans. By refinancing, you could kill two birds with one stone.

It’s your chance to kick Navient to the curb, and you may save money on student loan interest, too. So, while refinancing isn’t student loan forgiveness, it could be your best Navient student loan strategy.

But how can student loan borrowers know when refinancing is the right move? Here are three questions to ask yourself:

If you’re just starting student loan repayment, refinancing could save you a lot of money over the life of your loans.

But if you’ve already made three years of federal student loan payments toward Teacher Loan Forgiveness or five years toward Public Service Loan Forgiveness while working full-time, that changes the discussion completely. If you’re already well on your path toward earning Navient student loan forgiveness through a federal program, you should avoid refinancing with any private lenders.

If you do choose to stay with Navient, make sure you’re on the right repayment plan and filing your taxes the right way. You should also be vigilant in making sure that Navient is handling your loans correctly. If your loans are in default with Navient, you may need to reach out to a student loan attorney.

When you refinance federal student loans, you become ineligible to base your monthly payment amount on your income or to apply for federal forbearance or deferment. Your loan type changes from federal to private. So in other words, federal student loan borrowers will have less payment flexibility with private student loans. Rain or shine, the bills will just keep on coming — while federal borrowers have taken advantage of the recent payment pause and are hoping for Biden's debt relief to go through.

So, do you have an emergency fund in place? If not, you may want to reach that goal before refinancing federal student loans.

There are two other financial factors to consider: your credit score and debt-to-income ratio. If you have a credit score over 650 and you owe less than 1.5 times your income, you could be a prime candidate for refinancing. Otherwise, you may want to stick with the loans you received from the Federal Student Aid office.

If you only expect your income to grow over the next few years, refinancing could be a great move. Income-driven repayment plans will become progressively less helpful as you make more money. Plus, you’ll be shackled to your student loans for 20 years or more, and you’ll pay a lot more in interest.

But if your job situation is unstable, you may want to stick with federal student loans since they provide more repayment options. Knowing that income-driven repayment (IDR) is available if you were to need it can be a comfort. And if your job situation stabilizes, you can always refinance later.

Wondering if refinancing is worth it? Consider this. Let’s say you had $100,000 in student loans at 6.5% interest rate. Let’s also say that you chose to stay on the Standard 10-Year Repayment Plan. In that case, you’d pay $36,257 in interest over the life of your loans.

But by refinancing to private student loans at 3.5%, your interest cost would drop to $18,663. That’s a savings of over $17,500. Plus, you’d have a lower monthly payment amount along the way and would be free of Navient and its problems. Just make sure to review your credit report and score to see if you qualify.

If you’re thinking about refinancing your Navient student loans, Student Loan Planner® can help you find a great deal. By taking smaller payouts than our competitors for our referral links, we’re able to offer our readers some of the highest cash bonuses available online.

Depending on your student loan balance, you may be eligible to earn a $350 to $1,275 cash-back bonus. See how much you could save!

Disclosures

*Includes optional 0.25% Auto Pay discount. For 100k or more. Fixed 4.99 - 9.99% APR* Variable 6.24 - 9.99% APR*Disclosures

$1,000 Bonus For 100k or more. $300 for 50k to $99,999 Fixed 4.99 - 10.24% APPR Variable 5.28 - 10.24% APRDisclosures

$1,000 Bonus For 100k or more. $200 for 50k to $99,999 Fixed 4.89 - 9.74% APR Variable 5.89 - 9.74% APRDisclosures

$1,050 Bonus For 100k+, $300 for 50k to 99k. Fixed 5.24 - 9.15% APR Variable 5.34 - 9.25% APRDisclosures

$1,275 Bonus For 150k+, $300 to $575 for 50k to 149k. Fixed 4.84 - 8.69% APR Variable 5.28 - 8.99% APRDisclosures

$1,250 Bonus For 100k+, $350 for 50k to 100k. $100 for 5k to 50k Fixed 4.84 - 10.99% APR Variable 5.28 - 12.45% APR Show All 6 lendersTake our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Clint ProctorClint Proctor is a freelance writer and founder of WalletWiseGuy.com, where he writes about how students and millennials can win with money. When he's away from his keyboard, he enjoys drinking coffee, traveling, obsessing over the Green Bay Packers and spending time with his wife and two boys.

Comments are closed.

SoFi: Fixed rates range from 4.99% APR to 9.99% APR with 0.25% autopay discount. Variable rates range from 6.24% APR to 9.99% APR with a 0.25% autopay discount. Unless required to be lower to comply with applicable law, Variable Interest rates will never exceed 13.95% (the maximum rate for these loans). SoFi rate ranges are current as of 08/26/24 and are subject to change at any time. Your actual rate will be within the range of rates listed above and will depend on the term you select, evaluation of your creditworthiness, income, presence of a co-signer and a variety of other factors. Lowest rates reserved for the most creditworthy borrowers. For the SoFi variable-rate product, the variable interest rate for a given month is derived by adding a margin to the 30-day average SOFR index, published two business days preceding such calendar month, rounded up to the nearest one hundredth of one percent (0.01% or 0.0001). APRs for variable-rate loans may increase after origination if the SOFR index increases. The SoFi 0.25% autopay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. This benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. The benefit lowers your interest rate but does not change the amount of your monthly payment. This benefit is suspended during periods of deferment and forbearance. Autopay is not required to receive a loan from SoFi. You may pay more interest over the life of the loan if you refinance with an extended term.

Student Loan Planner® Bonus Disclosure

Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. Borrowers must complete the Refinance Bonus Request form to claim a bonus offer. Student Loan Planner® will confirm loan eligibility and, upon confirmation of a qualifying refinance, will send via email a $500 e-gift card within 14 business days following the last day of the month in which the qualifying loan was confirmed eligible by Student Loan Planner®. If a borrower does not claim the Student Loan Planner® bonus within six months of the loan disbursement, the borrower forfeits their right to claim said bonus. The bonus amount will depend on the total loan amount disbursed. This offer is not valid for borrowers who have previously received a bonus from Student Loan Planner®.

Splash Financial, Inc. (NMLS #1630038), licensed by the DFPI under California Financing Law, license # 60DBO-102545

Terms and conditions apply. Loan or savings calculators are offered for your own use and the results are based on the information you provide. The results of this calculator are only intended as an illustration and are not guaranteed to be accurate. Actual payments and figures may vary. Splash Financial loans are available through arrangements with lending partners. Your loan application will be submitted to the lending partner and be evaluated at their sole discretion. For loans where a credit union is the lender or a purchaser of the loan, in order to refinance your loans, you will need to become a credit union member. The Splash Student Loan Refinance Program is not offered or endorsed by any college or university. Neither Splash Financial nor the lending partner are affiliated with or endorse any college or university listed on this website. You should review the benefits of your federal student loan; it may offer specific benefits that a private refinance/consolidation loan may not offer. If you work in the public sector, are in the military or taking advantage of a federal department of relief program, such as income-based repayment or public service forgiveness, you may not want to refinance, as these benefits do not transfer to private refinance/consolidation loans. Splash Financial and our lending partners reserve the right to modify or discontinue products and benefits at any time without notice. To qualify, a borrower must be a U.S. citizen and meet our lending partner’s underwriting requirements. Lowest rates are reserved for the highest qualified borrowers. Products may not be available in all states. The information you provide is an inquiry to determine whether Splash’s lending partners can make you a loan offer but does not guarantee you will receive any loan offers. If you do not use the specific link included on this website, offers on the Splash website may include offers from lending partners that have a higher rate. This information is current as of July 18, 2024.

Rates are subject to change without notice. Not all applicants will qualify for the lowest rate. Lowest rates are reserved for the most creditworthy applicants and will depend on credit score, loan term, and other factors. Lowest rates may require an autopay discount of 0.25%. Variable APRs and amounts subject to increase or decrease.

Fixed APR: Annual Percentage Rate (APR) is the cost of credit calculating the interest rate, loan amount, repayment term and the timing of payments. Fixed Rate options range from 4.99% APR (with autopay) to 10.24% APR (without autopay) and will vary based on application terms, level of degree and presence of a co-signer.

Variable APR: Annual Percentage Rate (APR) is the cost of credit calculating the interest rate, loan amount, repayment term and the timing of payments. Variable rate options range from 5.28% APR (with autopay) to 10.24% APR (without autopay) and will vary based on application terms, level of degree and presence of a co-signer. Variable rates are derived by adding a margin to the 30-day average SOFR index, published two business days preceding such calendar month, rounded up to the nearest one hundredth of one percent (0.01% or 0.0001).

The minimum monthly payment of $100 while in the Residency Period may not pay all

of the interest due each month, which will likely result in negative amortization and a

larger principal balance when you enter the Full Repayment Period. Dental residents

and fellows are unable to receive additional tuition liabilities for the duration of their

Residency Period.

Splash: If you refinance over $100,000 through this site, $500 of the cash bonus listed above is provided directly by Student Loan Planner. Lowest rates displayed may include an autopay discount of 0.25%.

To begin the qualification process for the Student Loan Planner® sign on bonus, customers must apply from the link provided. Customers who are approved for and close a loan will receive the $300-$500 bonus through Splash Financial. The amount of the bonus will depend on the total loan amount disbursed. There is a limit of one bonus per borrower. This offer is not valid for current Splash customers who refinance their existing Splash loans, customers who have previously received a bonus, or with any other bonus offers received from Splash via this or any other channel. If the applicant was referred using the referral bonus, they will not receive the bonus provided via the referring party. Additional terms and conditions apply.

For the $1,000 bonus associated with refinancing at least $100,000, $500 of the bonus is provided by Student Loan Planner® via Giftly, which can be redeemed as a deposit to your bank account or PayPal account. Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. Borrowers must complete the Refinance Bonus Request form to claim a bonus offer. Student Loan Planner® will confirm loan eligibility and, upon confirmation of a qualifying refinance, will send via email a $500 e-gift card within 14 business days following the last day of the month in which the qualifying loan was confirmed eligible by Student Loan Planner®. If a borrower does not claim the Student Loan Planner® bonus within six months of the loan disbursement, the borrower forfeits their right to claim said bonus. The bonus amount will depend on the total loan amount disbursed. This offer is not valid for borrowers who have previously received a bonus from Student Loan Planner®.

THIS IS AN ADVERTISEMENT. YOU ARE NOT REQUIRED TO MAKE ANY PAYMENT OR TAKE ANY OTHER ACTION IN RESPONSE TO THIS OFFER.

Earnest: $1,000 for $100K or more, $200 for $50K to $99.999.99. For Earnest, if you refinance $100,000 or more through this site, $500 of the $1,000 cash bonus is provided directly by Student Loan Planner. Rate range above includes optional 0.25% Auto Pay discount.

Earnest Bonus Offer Disclosure:

Terms and conditions apply. To qualify for this Earnest Bonus offer: 1) you must not currently be an Earnest client, or have received the bonus in the past, 2) you must submit a completed student loan refinancing application through the designated Student Loan Planner® link; 3) you must provide a valid email address and a valid checking account number during the application process; and 4) your loan must be fully disbursed.

You will receive a $1,000 bonus if you refinance $100,000 or more, or a $200 bonus if you refinance an amount from $50,000 to $99,999.99. For the $1,000 Welcome Bonus offer, $500 will be paid directly by Student Loan Planner® via Giftly. Earnest will automatically transmit $500 to your checking account after the final disbursement. For the $200 Welcome Bonus offer, Earnest will automatically transmit the $200 bonus to your checking account after the final disbursement. There is a limit of one bonus per borrower. This offer is not valid for current Earnest clients who refinance their existing Earnest loans, clients who have previously received a bonus, or with any other bonus offers received from Earnest via this or any other channel. Bonus cannot be issued to residents in KY, MA, or MI.

Interest Rate Disclosure

Actual rate and available repayment terms will vary based on your income. Fixed rates range from 5.44% APR to 9.99% APR (excludes 0.25% Auto Pay discount). Variable rates range from 6.24% APR to 9.99% APR (excludes 0.25% Auto Pay discount). Earnest variable interest rate student loan refinance loans are based on a publicly available index, the 30-day Average Secured Overnight Financing Rate (SOFR) published by the Federal Reserve Bank of New York. The variable rate is based on the rate published on the 25th day, or the next business day, of the preceding calendar month, rounded to the nearest hundredth of a percent. The rate will not increase more than once per month. The maximum rate for your loan is 8.95% if your loan term is 10 years or less. For loan terms of more than 10 years to 15 years, the interest rate will never exceed 9.95%. For loan terms over 15 years, the interest rate will never exceed 11.95%. Please note, we are not able to offer variable rate loans in AK, IL, MN, NH, OH, TN, and TX. Our lowest rates are only available for our most credit qualified borrowers and contain our .25% auto pay discount from a checking or savings account.

Auto Pay Discount Disclosure

You can take advantage of the Auto Pay interest rate reduction by setting up and maintaining active and automatic ACH withdrawal of your loan payment. The interest rate reduction for Auto Pay will be available only while your loan is enrolled in Auto Pay. Interest rate incentives for utilizing Auto Pay may not be combined with certain private student loan repayment programs that also offer an interest rate reduction. For multi-party loans, only one party may enroll in Auto Pay.

Skip a Payment Disclosure

Earnest clients may skip one payment every 12 months. Your first request to skip a payment can be made once you’ve made at least 6 months of consecutive on-time payments, and your loan is in good standing. The interest accrued during the skipped month will result in an increase in your remaining minimum payment. The final payoff date on your loan will be extended by the length of the skipped payment periods. Please be aware that a skipped payment does count toward the forbearance limits. Please note that skipping a payment is not guaranteed and is at Earnest’s discretion. Your monthly payment and total loan cost may increase as a result of postponing your payment and extending your term.

Student Loan Refinancing Loan Cost Examples

These examples provide estimates based on payments beginning immediately upon loan disbursement. Variable APR: A $10,000 loan with a 20-year term (240 monthly payments of $72) and a 5.89% APR would result in a total estimated payment amount of $17,042.39. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed APR: A $10,000 loan with a 20-year term (240 monthly payments of $72) and a 6.04% APR would result in a total estimated payment amount of $17,249.77. Your actual repayment terms may vary.Terms and Conditions apply. Visit https://www.earnest. com/terms-of-service, e-mail us at hello@earnest.com, or call 888-601-2801 for more information on our student loan refinance product.

Student Loan Origination Loan Cost Examples

These examples provide estimates based on the Deferred Repayment option, meaning you make no payments while enrolled in school and during the separation period of 9 billing periods thereafter. Variable APR: A $10,000 loan with a 15-year term (180 monthly payments of $157.12) and an 11.69% APR would result in a total estimated payment amount of $21,290.40. For a variable loan, after your starting rate is set, your rate will then vary with the market. Fixed APR: A $10,000 loan with a 15-year term (180 monthly payments of $173.51) and an 13.03% APR would result in a total estimated payment amount of $22,827.79. Your actual repayment terms may vary.

Earnest Loans are made by Earnest Operations LLC or One American Bank, Member FDIC. Earnest Operations LLC, NMLS #1204917. 535 Mission St., Suite 1663, San Francisco, CA 94105. California Financing Law License 6054788. Visit earnest.com/licenses for a full list of licensed states. For California residents (Student Loan Refinance Only): Loans will be arranged or made pursuant to a California Financing Law License.

One American Bank, 515 S. Minnesota Ave, Sioux Falls, SD 57104. Earnest loans are serviced by Earnest Operations LLC with support from Navient Solutions LLC (NMLS #212430). One American Bank and Earnest LLC and its subsidiaries are not sponsored by or agencies of the United States of America.

© 2021 Earnest LLC. All rights reserved.

Student Loan Planner® Bonus Disclosure:

Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. Borrowers must complete the Refinance Bonus Request form to claim a bonus offer. Student Loan Planner® will confirm loan eligibility and, upon confirmation of a qualifying refinance, will send via email a $500 e-gift card within 14 business days following the last day of the month in which the qualifying loan was confirmed eligible by Student Loan Planner®. If a borrower does not claim the Student Loan Planner® bonus within six months of the loan disbursement, the borrower forfeits their right to claim said bonus. The bonus amount will depend on the total loan amount disbursed. This offer is not valid for borrowers who have previously received a bonus from Student Loan Planner®.

Laurel Road: If you refinance more than $250,000 through our link and Student Loan Planner receives credit, a $500 cash bonus will be provided directly by Student Loan Planner. If you are a member of a professional association, Laurel Road might offer you the choice of an interest rate discount or the $300, $500, or $750 cash bonus mentioned above. Offers from Laurel Road cannot be combined. Rate range above includes optional 0.25% Auto Pay discount.

Laurel Road Bonus Offer Disclosure:

Rates as of 8/15/24. Rates Subject to Change. Terms and Conditions Apply. All products subject to credit approval. Laurel Road disclosures. To qualify for this Laurel Road Welcome Bonus offer: 1) you must not currently be an Laurel Road client, or have received the bonus in the past, 2) you must submit a completed student loan refinancing application through the designated Student Loan Planner® link; 3) you must provide a valid email address and a valid checking account number during the application process; and 4) your loan must be fully disbursed. If a borrower is eligible for and chooses to accept an interest rate promotional offer due to that borrower’s membership in a professional association, the borrower will not be eligible for the cash bonus from Laurel Road. However, the borrower can still be eligible for the Student Loan Planner® bonus if they qualify under the “Student Loan Planner® Bonus Disclosure terms below.” If you opt to receive the cash bonus incentive offer, you will receive a $1,050 bonus if you refinance $100,000 or more, or a $300 bonus if you refinance an amount from $50,000 to $99,999.99. For the $1,050 Welcome Bonus offer, $500 will be paid directly by Student Loan Planner® via Giftly. Laurel Road will automatically transmit $550 to your checking account after the final disbursement. For the $300 Welcome Bonus offer, Laurel Road will automatically transmit the $300 bonus to your checking account after the final disbursement. There is a limit of one bonus per borrower. This offer is not valid for current Laurel Road clients who refinance their existing Laurel Road loans, clients who have previously received a bonus, or with any other bonus offers received from Laurel Road via this or any other channel.

You can take advantage of the Auto Pay interest rate reduction by setting up and maintaining active and automatic ACH withdrawal of your loan payment. The interest rate reduction for Auto Pay will be available only while your loan is enrolled in Auto Pay. Interest rate incentives for utilizing Auto Pay may not be combined with certain private student loan repayment programs that also offer an interest rate reduction. For multi-party loans, only one party may enroll in Auto Pay

Student Loan Planner® Bonus Disclosure

Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. Borrowers must complete the Refinance Bonus Request form to claim a bonus offer. Student Loan Planner® will confirm loan eligibility and, upon confirmation of a qualifying refinance, will send via email a $500 e-gift card within 14 business days following the last day of the month in which the qualifying loan was confirmed eligible by Student Loan Planner®. If a borrower does not claim the Student Loan Planner® bonus within six months of the loan disbursement, the borrower forfeits their right to claim said bonus. The bonus amount will depend on the total loan amount disbursed. This offer is not valid for borrowers who have previously received a bonus from Student Loan Planner®.

Elfi: If you refinance over $150,000 through this site, $500 of the cash bonus listed above is provided directly by Student Loan Planner.

To begin the qualification process for the Student Loan Planner® sign on bonus, customers must apply from the link provided on https://www.elfi.com/student-loan-planner. Customers who are approved for and close a loan will receive the $300-$775 bonus through a reduction in the principal balance of their Education Loan Finance loan when your loan has been disbursed. The amount of the bonus will depend on the total loan amount disbursed. In order to receive this bonus, customers will be required to complete and submit a W9 form with all required documents. Taxes are the sole responsibility of the recipient. There is a limit of one bonus per borrower. This offer is not valid for current ELFI customers who refinance their existing ELFI loans, customers who have previously received a bonus, or with any other bonus offers received from ELFI via this or any other channel. If the applicant was referred using the referral bonus, they will not receive the bonus provided via the referring party. If the applicant becomes an ELFI customer, they may participate in the referral bonus by becoming the referring party. Additional terms and conditions apply.

For the $1,275 bonus associated with refinancing at least $150,000, $500 of the bonus is provided by Student Loan Planner® via Giftly, which can be redeemed as a deposit to your bank account or PayPal account. Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. Borrowers must complete the Refinance Bonus Request form to claim a bonus offer. Student Loan Planner® will confirm loan eligibility and, upon confirmation of a qualifying refinance, will send via email a $500 e-gift card within 14 business days following the last day of the month in which the qualifying loan was confirmed eligible by Student Loan Planner®. If a borrower does not claim the Student Loan Planner® bonus within six months of the loan disbursement, the borrower forfeits their right to claim said bonus. The bonus amount will depend on the total loan amount disbursed. This offer is not valid for borrowers who have previously received a bonus from Student Loan Planner®.

Credible: If you refinance over $100,000 through this site, $500 of the cash bonus listed above is provided directly by Student Loan Planner.

To begin the qualification process for the Student Loan Planner® sign on bonus, customers must apply from the link provided on www.credible.com.

All bonus payments are by e-gift card. See terms. The amount of the bonus will depend on the total loan amount disbursed. In order to receive this bonus, customers will be required to complete and submit a W9 form with all required documents. Taxes are the sole responsibility of the recipient. A customer will only be eligible to receive the bonus one time. New applicants are eligible for only one bonus. Additional terms and conditions apply.

For the $1,250 bonus associated with refinancing at least $100,000, $500 of the bonus is provided by Student Loan Planner® via Giftly, which can be redeemed as a deposit to your bank account or PayPal account. Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. Borrowers must complete the Refinance Bonus Request form to claim a bonus offer. Student Loan Planner® will confirm loan eligibility and, upon confirmation of a qualifying refinance, will send via email a $500 e-gift card within 14 business days following the last day of the month in which the qualifying loan was confirmed eligible by Student Loan Planner®. If a borrower does not claim the Student Loan Planner® bonus within six months of the loan disbursement, the borrower forfeits their right to claim said bonus. The bonus amount will depend on the total loan amount disbursed. This offer is not valid for borrowers who have previously received a bonus from Student Loan Planner®.

Student loan refinance interest disclosure

The lenders on the Credible.com platform offer fixed rates ranging from 4.94% – 10.99% APR. Variable interest rates offered by the lenders on Credible.com range from 5.28% – 12.45% APR. Variable rates will fluctuate over the term of the borrower’s loan with changes in the Index rate. The Index will be either LIBOR, SOFR, or the Prime Rate of interest as published in the Wall Street Journal (WSJ). The maximum variable rate on the Education Refinance Loan is the greater of 21.00% or Prime Rate plus 9.00%. Rates are subject to change at any time without notice. Your actual rate may be different from the rates advertised and/or shown above and will be based on factors such as the term of your loan, your financial history (including your cosigner’s (if any) financial history) and the degree you are in the process of achieving or have achieved. While not always the case, lower rates typically require creditworthy applicants with creditworthy cosigners, graduate degrees, and shorter repayment terms (terms vary by lender and can range from 5-20 years) and include loyalty and Automatic Payment discounts, where applicable. Loyalty and Automatic Payment discount requirements as well as Lender terms and conditions will vary by lender and therefore, reading each lender’s disclosures is important. Additionally, lenders may have loan minimum and maximum requirements, degree requirements, educational institution requirements, citizenship and residency requirements as well as other lender-specific requirements.

Advertising DisclosureThis post may contain affiliate links, which means Student Loan Planner may receive a commission, at no extra cost to you, if you click through to make a purchase. Please read our full disclaimer for more information. In some cases, you could obtain a better deal from our advertising partners than you could obtain by utilizing their services or products directly. This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author alone.

Life gets better when you know what to do with your student loans. Book a one-hour consulting call today. Your future self will thank you.

© Copyright 2016-2024 Student Loan Planner®. All Rights Reserved.

Product name, logo, brands, and other trademarks featured or referred to within Student Loan Planner® are the property of their respective trademark holders. Information obtained via Student Loan Planner® is for educational purposes only. Please consult a licensed financial professional before making any financial decisions. This site may be compensated through third party advertisers. This site is not endorsed or affiliated with the U.S. Department of Education.